World-class investment managers driven by relationships and data.

At Ridgepost Capital, relationships are everything. We’ve built them over decades, and they drive our relentless commitment to a data-driven investment process.

By continually evolving, Ridgepost Capital has built an unrivaled network of strategies with deep industry knowledge across several strategies. Together, we offer our clients a unified solution and unrivaled access to private markets.

We hold an ongoing commitment to expanding our capabilities and investment products across private market strategies where relationships, data, and market intelligence are crucial to successful investing.

We are dedicated to servicing our shareholders, LPs, GPs, employees, and community.

RCP Advisors 2, LLC is acquired.

RCP Advisors was founded in 2001.

RCP Advisors 3, LLC is acquired.

RCP Advisors was founded in 2001.

Five Points Capital is acquired.

Five Points Capital was founded in 1997.

TrueBridge is acquired.

TrueBridge was founded in 2007.

Enhanced Capital Partners is acquired.

Enhanced Capital was founded in 1999.

Hark Capital is acquired.

Hark Capital was founded in 2012.

Bonaccord Capital Partners is acquired.

Bonaccord Capital Partners was founded in 2017.

P10 begins trading on the NYSE under the symbol PX.

Western Technology Investment (WTI) is acquired.

WTI was founded in 1980.

Qualitas Funds is acquired.

Qualitas Funds was founded in 2015.

P10 begins trading on the NYSE Texas exchange.

P10 becomes Ridgepost Capital trading on the NYSE under the symbol RPC.

Our deep industry network opens doors to new opportunities, sources comprehensive data, enhances returns, and attracts new capital.

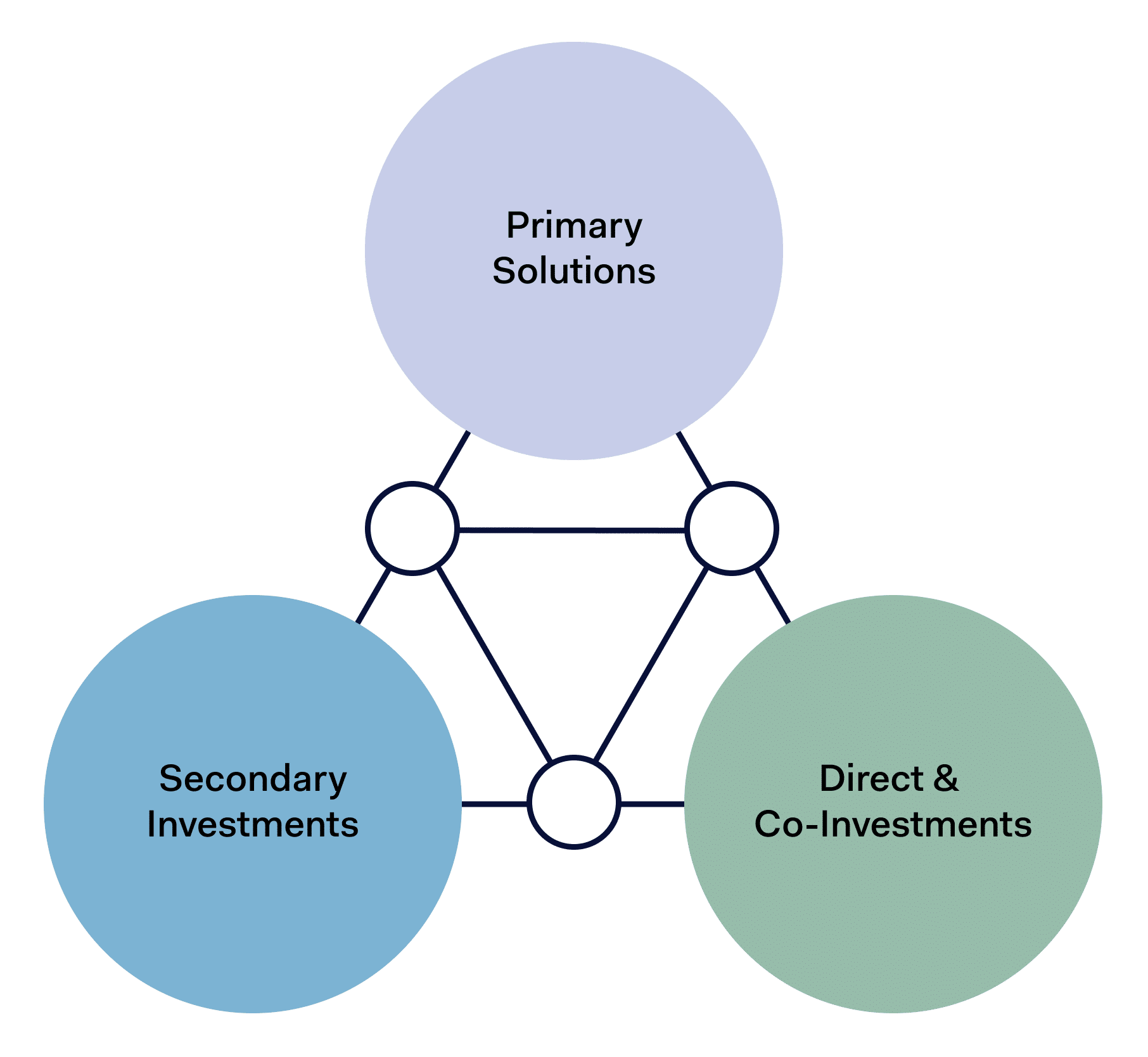

Ridgepost Capital focuses on identifying and leveraging opportunities for long-term value creation. Through our strategies, RCP Advisors and Bonaccord Capital Partners in North America, and Qualitas Funds in Europe, we offer unrivaled access to a deep network of relationships and crucial resources in the middle and lower middle market.

Learn more

Ridgepost Capital opens doors to alternative credit investing in the lower middle market through our strategies, Enhanced Capital, Western Technology Investment (WTI), Hark Capital, and Five Points Capital.

Learn more

Ridgepost Capital is well positioned to continue raising and deploying capital at exceptional risk-adjusted returns on behalf of investors. Our strategy TrueBridge is a leader in venture capital investing and lends both decades of expertise and rich data analysis to drive our VC strategy.

Learn more

Ridgepost Capital focuses on identifying and leveraging opportunities for long-term value creation.

Through our strategies, RCP Advisors and Bonaccord Capital Partners in North America, and Qualitas Funds in Europe, we offer unrivaled access to a deep network of relationships and crucial resources in the middle and lower middle market.

![]()

RCP Advisors is a private equity investment firm that provides access to lower middle market private equity fund managers through primary funds-of-funds, secondary funds, and co-investment funds, as well as provides advisory and investment research services.

Bonaccord Capital Partners is a private equity business focused on acquiring non-control equity interests in mid-market private markets sponsors.

Qualitas Funds is an alternative investment manager focused on the European private equity lower middle market, offering investors access to best-in-class private equity funds and co-investments.

Investment professionals

Vehicles

Inception

Ridgepost Capital opens doors to alternative credit investing in the lower middle market through our strategies, Enhanced Capital, Western Technology Investment (WTI), Hark Capital, and Five Points Capital.

![]()

Enhanced Capital provides Project Finance loans to developers of Climate and Impact Real Estate projects, and corporate loans to Small Business Owners.

Established in 1980, WTI pioneered the concept and execution of venture debt. Across several market cycles, WTI has maintained their position as a trusted partner to many of the world’s greatest tech innovators.

![]()

Hark Capital is a pioneer in creative fund financing solutions. The firm provides NAV-based loans to financial sponsors based on the value of their unrealized portfolios in situations that would typically require equity.

![]()

Five Points Capital has been a leading provider of private credit to the lower middle market since 2006. The firm primarily targets growth-oriented, high return on net asset businesses with attractive, defensible market positions.

Investment professionals

Vehicles

Inception

Ridgepost Capital is well positioned to continue raising and deploying capital at exceptional risk-adjusted returns on behalf of investors.

Our strategy TrueBridge is a leader in venture capital investing and lends both decades of expertise and rich data analysis to drive our VC strategy.

![]()

TrueBridge is a leading venture capital firm focused on investing in elite, access-constrained venture capital funds, as well as directly in select venture-backed companies.

Investment professionals

Vehicles

Inception

Our people power our success: we are committed to fostering a meritocracy that rewards superior performance and empowers individuals to contribute meaningfully to that success. We value thoughtful, open dialogue from diverse perspectives and believe that active collaboration and constructive debate across our team leads to superior outcomes.

We hold ourselves to the highest ethical standards and always act with honesty, transparency, and dependability.

We seek to cultivate enduring and collaborative relationships with clients, sponsors, and shareholders that are aligned with our long-term vision of building a world-class investment platform.

We are committed to excellence in everything we do and aim to deliver superior performance and operational rigor, guided by focus and discipline, to create long-term value for our stakeholders.

We seek exceptional talent and a collaborative spirit. If you’re interested in joining Ridgepost Capital or one of our strategies, introduce yourself and submit a resume to HR@ridgepostcapital.com.

If you’re a GP, LP, or investment professional, we want to hear from you.